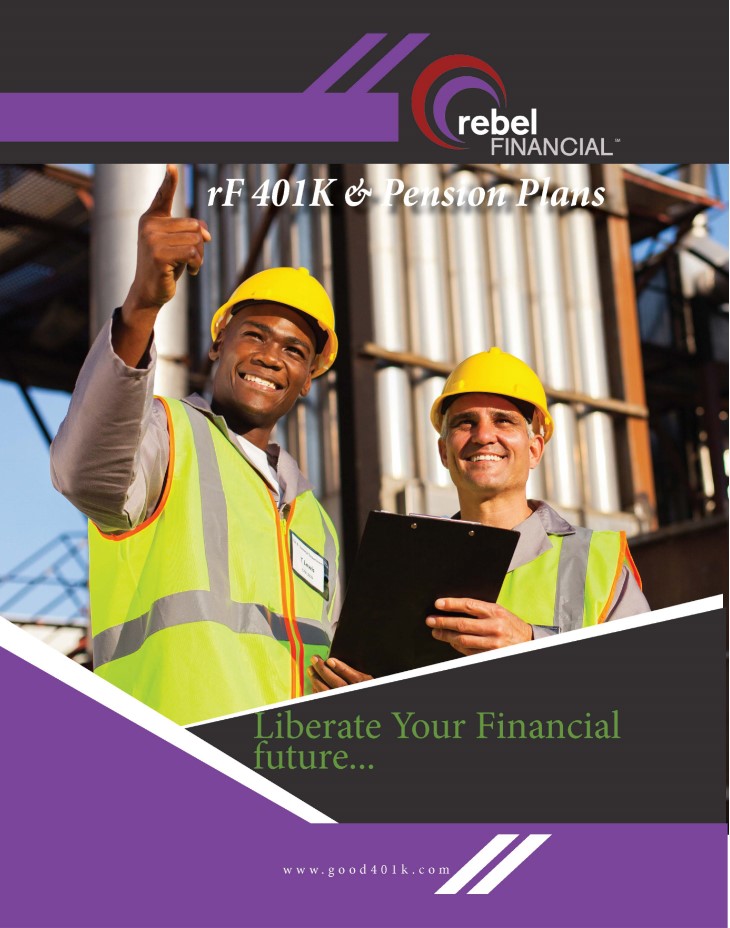

We build 401k plans that are good for you,

and your employees.

rebel Financial is an independent local Registered Investment Advisor (RIA) that builds custom retirement plans for small to medium size business. We build our plans from scratch and bundle all services together to save you money and build great retirement plans for you as the employer and also for your employees.

- We are not a re-seller, we build your plan from scratch.

- Always a Fiduciary to you and your employees.

- We are "Fee-Only."

Building a better financial future, one plan at a time:

3(38) Fiduciary

What this means is that we have a legal responsibility to act in the best interests of you and your employees.

Transparent pricing

We are open and transparent in our pricing. We strive to make our process easy to understand so that you and your employees can evaluate the true value we deliver:

Fast plan design & implementation

In collaboration with you and our TPA, we will build you a plan that fits your business and then get it implemented quickly so that you and your employees can begin to realize it’s benefits as quickly as possible.

Fee-only

Fee-only means that we only accept compensation from you and your employees. We do not share revenue or take kick backs from any fund, investment, or insurance company, as most other 401k providers do, which provides further assurance that we represent your interests 1st.

Cutting edge technology

As a smaller company, freed from the bureaucratic gridlock of most large institutions, we implement the newest technology years before most of our competitors to build your plan with the best available tools.

Freedom

As with everything else we do as a firm, we do not lock our clients into restrictive contract terms and work only contingent upon your complete satisfaction. You may terminate at any time with no termination charge from rebel Financial.

Great online platform

Great online access for you and your employees to monitor accounts and track retirement progress. Access your accounts from a PC, Mac, tablet or smart phone.

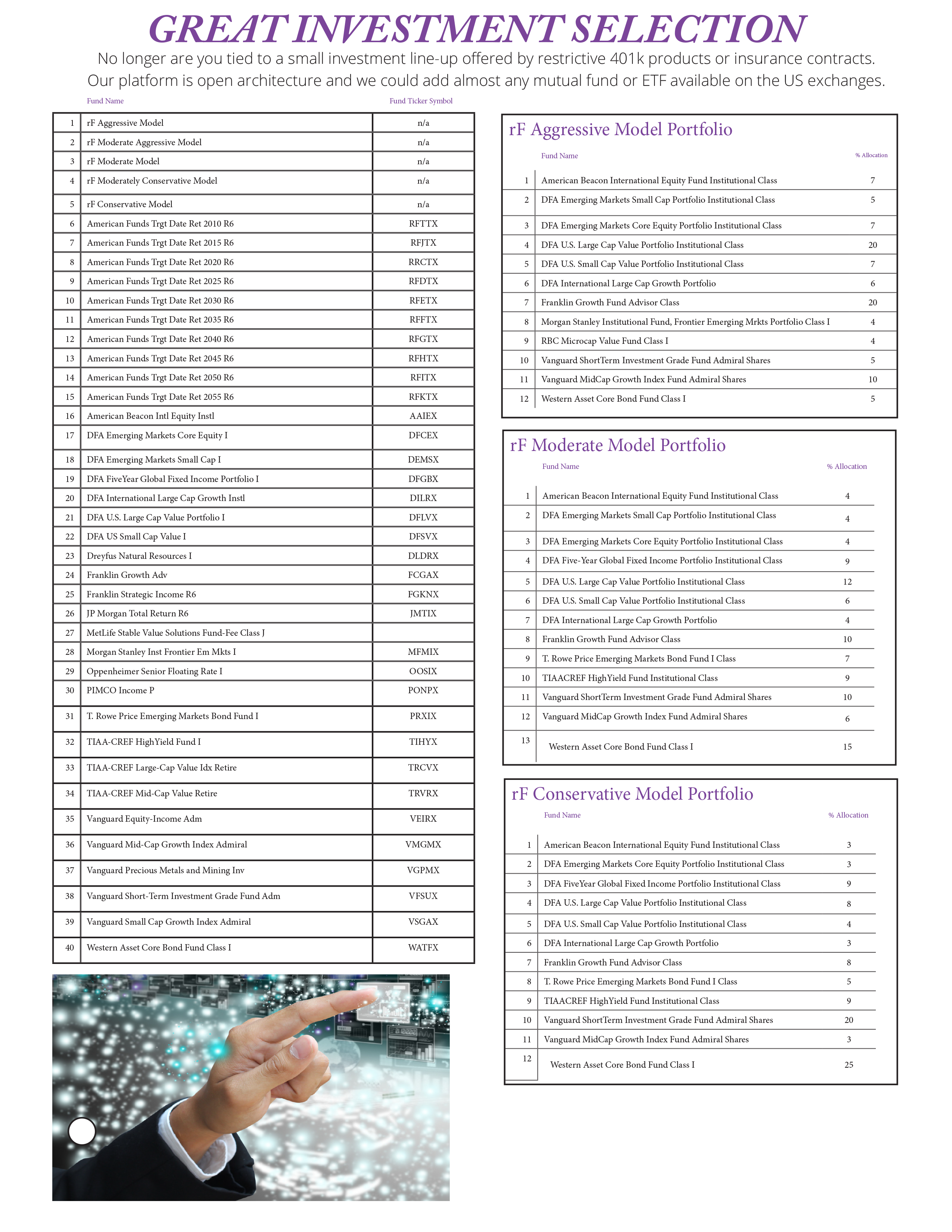

Great Investment Selection

No longer are you tied to a small investment line-up offered by restrictive 401k products or insurance contracts. Our platform is open architecture and we could add almost any mutual fund or ETF available on the US exchanges.

Click the picture to the right to view our sample line-up →

Model Portfolios to help participants

We have model portfolios in which we pick the funds for your employees, rebalance as necessary, and try to stay up-to-date with your employees so that they will stick to their long-term investment strategy and actually earn the necessary returns to fulfill their retirement goals.

Services we provide:

To sponsors/employers:

Plan design services:

We consult with you at plan implementation and on-going throughout the life of you plan to help you build the best plan for your business and employees. We understand that these objectives may change over-time which is why we’re always collaborating with our plan sponsors to adapt their plans as their needs change.

Open architecture

We are truly open-architecture/built-from-scratch:

-We use no proprietary funds.

-There are no fund restrictions.

-We offset all mutual fund revenue.

-Any piece of our plan infrastructure can be replaced if it is no longer in our clients’ best interests: TPA, Recordkeeper, Custodian, Investment Manager, etc.

Fiduciary review and certification:

We review and certify every plan we take on. If we feel that a plan sponsor is doing something on a plan that we cannot certify then we will not take that plan on as a client. We truly believe in serving the best interests of our plan sponsors and every participant. Therefore, if there is something that violates that ethical “line in the sand” then we would forgo any potential economic benefit (no matter how large); We believe that doing the “right thing” has no monetary price tag.

Plan monitoring and benchmarking:

We will help you to understand how well you plan is doing compared to your peer group and your industry as well as continually collaborating with you to devise new strategies to improve your plan and, eventually, make it one of the best in your peer-group/industry.

A fiduciary partner:

ERISA provides a “safe harbor”, which limits a plan sponsor’s fiduciary liability where a qualified investment manager is appointed. A full delegation under ERISA section 3(38) represents the highest level of investment liability transfer possible under ERISA and rebel Financial specifically accepts this fiduciary status and discretion in writing for our plan sponsors.

To participants/employees:

Enrollment and educational meetings:

We provide enrollment and educational meetings and seminars to help your employees get the most out of your retirement plan so that they can succeed. Did you know that a properly funded and invested retirement account over an average employee’s career would contain almost 3 times more in growth than their actual contributions?!? It is a sad reality that this doesn’t happen for the vast majority of participants b/c of lack of education and participation.

Ability to chat and meet with a CFP:

We are a financial planning company at heart that has built a wonderful retirement platform. We have Certified Financial Professionals (CFP) that can help your employees when they have questions or need support that they just can’t receive from the 1-800# of most providers.

Access to professionally managed model portfolios:

We provide our professionally managed, model portfolios to your employees. These are managed in much the same way as we manage our individual high net worth clients’ accounts and they are specific to your plan. What’s more, we don’t charge extra for this service and offer it as an additional benefit to our plans.

Quarterly Market Update Videos:

As an addition to our model portfolios, we produce quarterly videos that explain what happened over the quarter, what we did to manage your participant’s investments, and reinforce why they’re invested the way that they are so they can stay invested and actually realize the great long-term investment returns that allude most investors.

Discounted financial planning services:

Again, financial planning is our specialty and we have streamlined our processes and technology so we can provide great financial planning services at lower prices to help more people. Even so, we will further discount any of your employees’ planning fees with us by 50% of the fee their account generated within the plan.

What you pay rF:

We have a very simple pricing model based on your plan’s total assets. As your plan grows, we’ll automatically apply discounts as you are eligible:

What you pay the custodian

The custodian is the larger financial company that actually holds your retirement plan assets and executes all of our instructions and trading (i.e. TD Ameritrade, Schwab, Matrix, Fidelity, etc). This will cost 0.02-0.04%/yr.

What you pay the TPA & recordkeeper

The TPA is like the accountant of your plan and the recordkeeper keeps all the details and records. We try to use firms that perform both of these duties to streamline your costs. Your TPA costs will be 0-0.1%/yr of plan assets, plus $1,000-$10,000/yr flat fee, plus ancillary fees for one-time service items (view sample pricing sheet).

What you pay the investment managers

Since this is an open architecture plan, fund expenses could be anywhere in between 0.05-5%/yr. However, we recommend that you only choose the most cost efficient funds for your plan. For example, if you took our current recommendation and we averaged the cost of our moderate model portfolio your net cost would be ~0.44%/yr.

Example 1

A Basic Safe Harbor 401k Plan with 5 participants and $250,000 plan asset total would cost:

Employer Fees:

1 – TPA flat fee: ~$1,750/yr.

2 – Individual fee for service items.Employee Fees:

1 – 0.7% rF + 0.1% TPA + 0.04% Custodian = 0.84%

2 – Avg fund management fee = 0.5%

3 – Total ~1.34%/yr.

Example 2

A Safe Harbor, Profit Sharing 401k Plan with 55 participants and $2,500,000 plan assets:

Employer Fees:

1 – TPA flat fee: ~$2,000/yr.

2 – Individual fee for service items.Employee Fees:

1 – 0.60% rF + 0.1% TPA + 0.04% Custodian = 0.74%

2 – Avg fund management fee = 0.5%

3 – Total ~1.24%/yr.

We are proud of the work we do for you and our other clients! Please feel free to see what others have said about us and please let everyone know what you think by leaving a review yourself.

Thank you so much for the opportunity to be of service and please let us know anytime how we can continue to improve so we can better guide all of our clients towards a brighter financial future!

Confident in our process & plans

We guarantee that if you are not completely satisfied with your plan, we will do everything in our power to correct it to your satisfaction. If that fails, then we will give you a 100% refund of the current quarterly fee due and proactively help you to transition to your new retirement plan.*

*Applies to the whole first year of plan installation and operation.